The telecom industry is a buzz with the recent tariff hikes, and savvy investors are on the lookout for promising stocks poised to benefit from these changes. Among the potential winners, Vodafone Idea Ltd. (IDEA) stands out as a compelling investment opportunity. Despite its tumultuous past, the stock’s recent performance and the industry’s evolving dynamics suggest it might be the best bet in the telecom sector. Here’s why:

The Tariff Hike: A Game Changer

The recent decision by telecom giant Jio to raise service prices has set the stage for other service providers, including Vodafone Idea, to follow suit. This strategic move is expected to boost revenue streams across the industry. For Vodafone Idea, which has been grappling with financial challenges, this could be a significant turning point. Increased tariffs mean higher Average Revenue Per User (ARPU), leading to better financial health and potentially higher profits.

Technical Analysis: Signs of a Reversal

A detailed analysis of Vodafone Idea’s stock chart reveals several promising signs:

- Emerging Uptrend: After years of decline, the stock has shown signs of stabilization and a potential uptrend since mid-2022. This change in trend is crucial as it indicates renewed investor confidence.

- Support and Resistance Levels: The stock has strong support around INR 8-10 and is currently testing the resistance at INR 20. A decisive break above this level could propel the stock to new heights, with the next resistance levels around INR 25 and INR 30.

- Volume and Moving Averages: Increased trading volumes on up days and the stock’s position above short-term moving averages suggest bullish momentum. If the stock crosses above its long-term moving average, it would confirm a more sustained upward trend.

- Chart Patterns: Patterns like the double bottom around the INR 8-10 level and an ascending triangle formation indicate potential bullish scenarios. A breakout from these patterns would signal strong buying interest and a likely price surge.

Fundamental Factors: Strengthening Financials

While technical indicators are promising, it’s essential to consider Vodafone Idea’s fundamental aspects:

- Revenue Growth: The tariff hike will directly impact Vodafone Idea’s ARPU, leading to improved revenue. This influx of cash can help the company manage its debt better and invest in expanding its services.

- Market Position: As one of the major players in India’s telecom industry, Vodafone Idea stands to gain significantly from the sector-wide price adjustments. Its extensive network and customer base provide a solid foundation for growth.

- Strategic Initiatives: Vodafone Idea’s efforts to streamline operations, reduce costs, and enhance service offerings will further strengthen its market position. Any positive developments in these areas could act as catalysts for the stock.

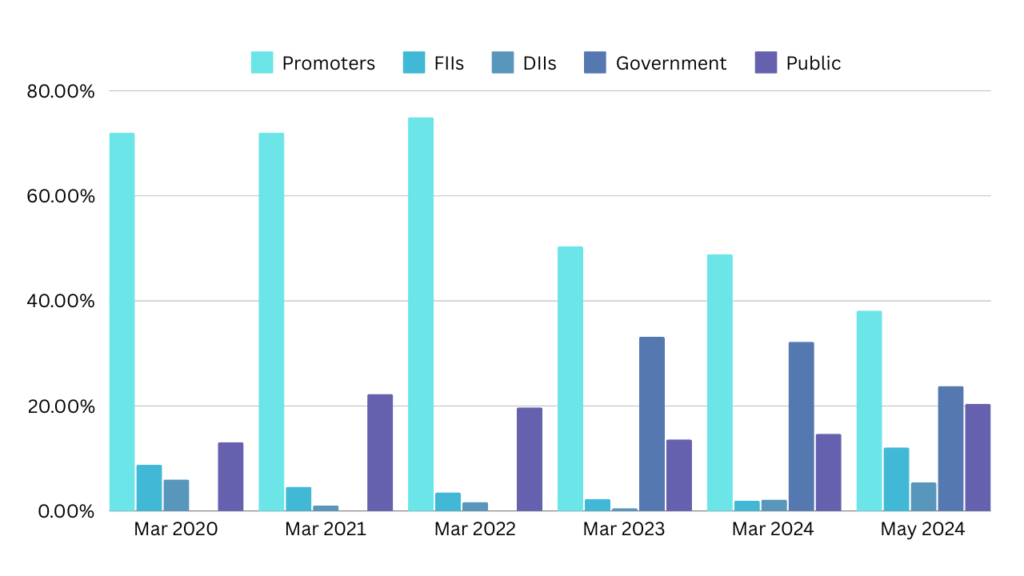

4. FII Bullishness: Just look the graph of FII shareholding in Mar 2023 it was 2.28 % in Mar 2024 it became 1.79 % But, in May 2024 it increased to 12.13 % yes we aren’t ignoring promoter holding have decreased But, Vodafone Idea is Gov controlled so, stability of government matter.

Investment Outlook: A Cautiously Optimistic Bet

Investing in Vodafone Idea comes with its share of risks, given the company’s historical financial struggles. However, the recent tariff hike presents a unique opportunity for the company to turn its fortunes around. For investors looking to capitalize on the telecom sector’s growth, Vodafone Idea offers a high-reward potential, especially if it successfully navigates the current landscape.

Conclusion

Vodafone Idea Ltd., trading at a promising two-digit price, is emerging as a strong contender in the telecom sector following the recent tariff hikes. With technical indicators pointing to a potential uptrend and fundamental factors suggesting improved financial health, this stock could be the best bet for investors looking to ride the wave of telecom industry growth. As always, thorough research and a keen eye on market developments are essential to making informed investment decisions.